Tuesday, December 23, 2008

Links

http://www.weeklystandard.com/Content/Public/Articles/000/000/015/921taekw.asp

Charlie Munger on THE PSYCHOLOGY OF HUMAN MISJUDGMENT:

http://vinvesting.com/docs/munger/human_misjudgement.html

Monday, December 1, 2008

I

Courtesy -Outlook

s there such a thing as 'Hindu terrorism', as the arrest of Sadhvi Pragya Singh Thakur for the recent

In the early 1980s, when I started freelancing in south

You cannot find anybody less fundamentalist than a Hindu in the world and it saddens me when I see the Indian and western press equating terrorist groups like SIMI, which blow up innocent civilians, with ordinary, angry Hindus who burn churches without killing anybody. We know also that most of these communal incidents often involve persons from the same groups—often Dalits and tribals—some of who have converted to Christianity and others not.

However reprehensible the destruction of Babri Masjid, no Muslim was killed in the process; compare this to the 'vengeance' bombings of 1993 in

I have never been politically correct, but have always written what I have discovered while reporting. Let me then be straightforward about this so-called Hindu terror. Hindus, since the first Arab invasions, have been at the receiving end of terrorism, whether it was by Timur, who killed 1,00,000 Hindus in a single day in 1399, or by the Portuguese Inquisition which crucified Brahmins in

So sometimes, enough is enough.At some point, after years or even centuries of submitting like sheep to slaughter, Hindus—whom the Mahatma once gently called cowards—erupt in uncontrolled fury. And it hurts badly. It happened in

There are about a billion Hindus, one in every six persons on this planet. They form one of the most successful, law-abiding and integrated communities in the world today. Can you call them terrorists?

Wednesday, March 26, 2008

Conspiracy Theory and all that

Some of the analysts have lately been talking about the loses that India inc. will take on its books this quarter due to huge MTM losses on their derivative positions. This, they claim, will cause a drop in reported earnings for majority of the companies for the first time in many quarters. While the logic seems to be fine there is one problem that I foresee. As pointed out by Andy Mukherjee in his article the Indian accounting rules are not yet clear on the MTM side so its not clear how many companies will actually end up reporting the true picture of their losses.

According to Jamal Mecklai, chief executive officer of Mumbai-based risk- management consulting firm Mecklai Financial, this month that Indian companies may have as much as $5 billion in marked-to- market losses on their currency positions.

Even so, as Mecklai noted in an interview posted on the Web site moneycontrol.com, Indian accounting norms don't require companies to mark these positions to market.

That means that bets that have turned unprofitable because of the U.S. currency's recent slide -- to a record against the euro last week and to a 12-year low against the Japanese yen -- may remain hidden from scrutiny until the contracts mature and the losses are realized.

This gives rise to a separate conspiracy theory. If the company intends not to disclose its losses this quarter (and I can give umpteen numbers of reasons for them not wanting to do that) then maybe they won't take their banks to court for the fear of disclosing how much they are slated to loose over bets they took on cross currency derivatives. There may be many who had no business taking these positions in the first place and who will now be more concerned about disclosure than loss.

Tuesday, March 25, 2008

Subprime explained

I don’t know if you have seen this earlier, but this animated story explains brilliantly, in a very simple language and without using too many words how the whole sub prime mess was created

Brilliance Redifined

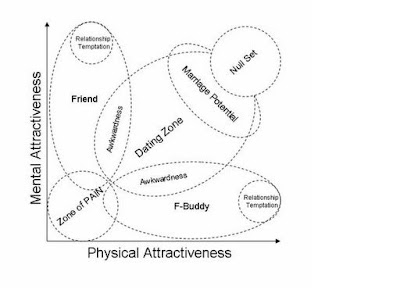

While I have seen really brilliant descriptions of extremely complex situations in the past, none comes even close to this graph depicting the status of any woman in a mans brain.

Hats off to whoever made this simplification chart of complicated human interactions. Especially because it is dead on accurate.

Monday, March 24, 2008

Those who cannot remember the past are condemned to repeat it

Dutch Tulip Bulb Bubble Bursts…Again

The Dutch were fooled again and fell victim to the siren's song of tulip bulbs:

Over there in the Netherlands, court proceedings are starting this week on the "biggest speculation fraud ever in the Netherlands", according to a national newspaper that ran a big story about it . Investors have lost tens of millions of euros in what turned out to be a big pyramid scheme.

Now for the ultimate irony. Any ideas what these people were investing in? Tulip bulbs. Reallyguess santayana will be smiling in his grave

Negative interest rates anyone??

Contrary to popular belief, interest rates can drop below zero and they have. AGAIN.. (Actually I didn’t know this happened earlier in 2003 too until I read the Fed paper)[link]

But negative repo rates on T-bills? apperently people had seen negative repo rates before on [possibly squeezed] notes and treasuries but none ever saw that on T-bills.

Quote 3 month T-bill repo: -0.20%

also 4 year notes around -0.25%.

The Fed paper [linked above] is an interesting insight and negates one more assumption of the financial markets that interest rates can not go below zero.